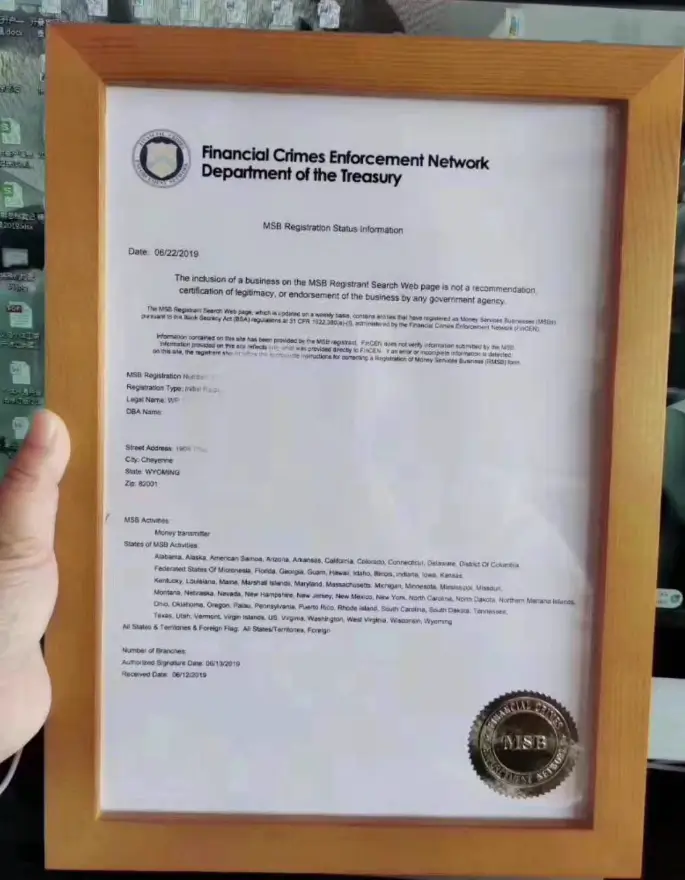

In today’s rapidly developing world of fintech and cryptocurrency industries,US MSB license(Money Services Business License) has become an option for many companies to expand their international business.、Important Tools for Improving Compliance。MSB license is issued byU.S. Financial Crimes Enforcement Network (FinCEN)issued,Mainly for companies engaged in money services business,including remittances、currency exchange、Payment processing etc.。

However,The process of applying for an MSB license can be complex and time-consuming。This article will provide you with a detailed compliance guide and practical advice,Help you quickly obtain a US MSB license。

one、What is a US MSB license?

The MSB license is a compliance requirement imposed by the U.S. financial regulator for companies engaged in money services business.。Companies holding MSB licenses can legally carry out the following businesses in the United States:

- Remittance and transfer services

- currency exchange

- payment processing

- Prepaid card issuance

- Cryptocurrency trading (in some cases)

MSB牌照不仅是企业合规运营的象征,It also enhances customer trust,Open the door to the U.S. and global markets for companies。

two、Key steps to apply for a US MSB license

1. Determine business scope

Before applying for an MSB license,Enterprises need to clarify whether their business scope falls within the scope of MSB supervision。If it involves money services business,You must apply for an MSB license。

2. Register a corporate entity

Companies applying for an MSB license need to register a corporate entity in the United States,and obtain a tax identification number (EIN)。This is a basic step in the application process。

3. Prepare application materials

To apply for an MSB license, you need to submit the following materials:

- Company registration documents

- Business description and operation plan

- Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) Policy

- Executive and shareholder details

- Compliance Officer Appointment Document

4. Submit application and pay fees

Submit your application through FinCEN’s online system,and pay the corresponding application fee。at present,The application fee for an MSB license is1,310Dollar。

5. Waiting for review

FinCEN will typically30to 60 daysComplete review within。If the materials are complete and meet the requirements,The company will obtain an MSB license。

three、Practical advice on obtaining an MSB license quickly

1. Prepare compliance documents in advance

Anti-money laundering (AML) and compliance policies are core components of applying for an MSB license。It is recommended that enterprises formulate a complete AML policy in advance,and appoint a professional compliance officer,To ensure that the application is successfully passed。

2. Seek professional consulting services

Application for an MSB license involves complex legal and regulatory requirements。It is recommended that enterprises seek professional compliance consulting services,To ensure that application materials meet FinCEN requirements,Avoid delays in review due to incomplete or incorrect materials。

3. Optimize internal processes

While applying for an MSB license,Enterprises should optimize internal operating processes,Ensure business complies with U.S. financial regulatory requirements。This will not only speed up the review,It can also lay the foundation for future compliance operations.。

4. Pay attention to regulatory developments

FinCEN’s regulatory policies may be adjusted at any time。Enterprises should pay close attention to relevant policy changes,Adjust application strategies in a timely manner,to avoid unnecessary delays。

Four、Subsequent compliance requirements for MSB licenses

After obtaining MSB license,Companies need to continue to comply with FinCEN’s regulatory requirements,include:

- Submit regularlyCurrency Transaction Report (CTR) and Suspicious Activity Report (SAR)

- Update MSB registration information every year

- Regularly review and update AML policies

five、Conclusion

The US MSB license is for companies to enter the US market、A vital tool for improving compliance and brand image。by preparing in advance、Optimize your process and seek professional help,Companies can quickly obtain MSB licenses,Lay a solid foundation for business development。

If you are considering applying for an MSB license,It is recommended to act as soon as possible,and ensure compliance with FinCEN requirements every step of the way。Compliance is not just a regulatory requirement,It is also a guarantee for the long-term development of the enterprise.。

Contact us now,Get a professionalUS MSB license applicationsupport,Helping you achieve compliance goals quickly!