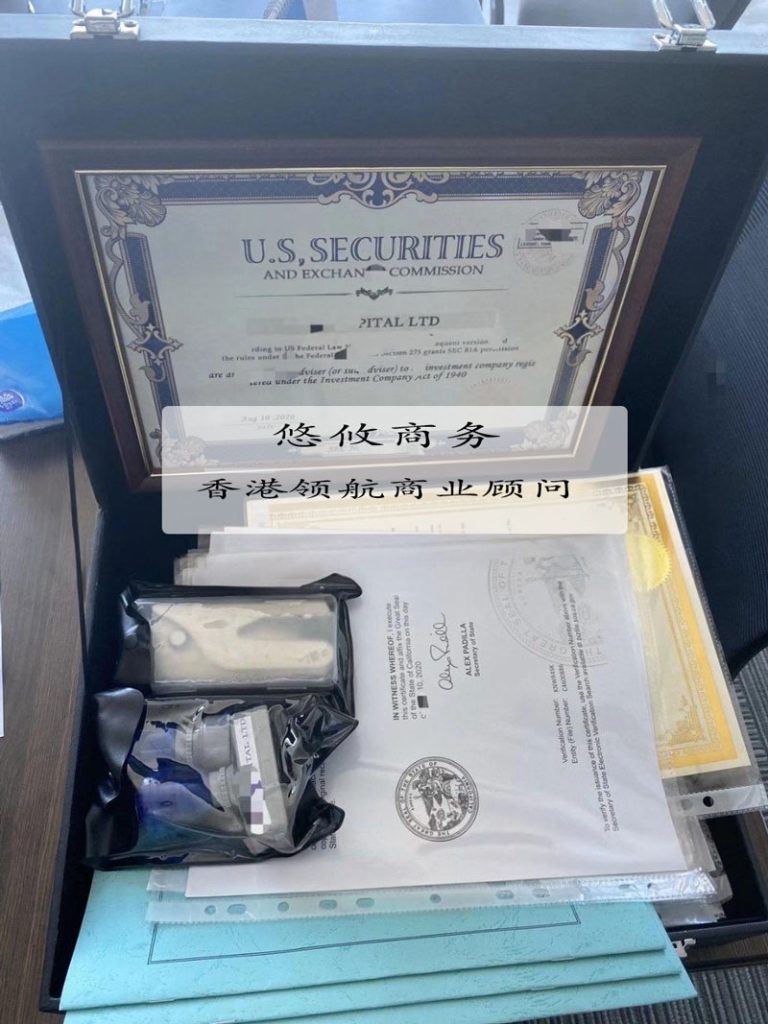

front page - Serve - Overseas financial license - US RIA license

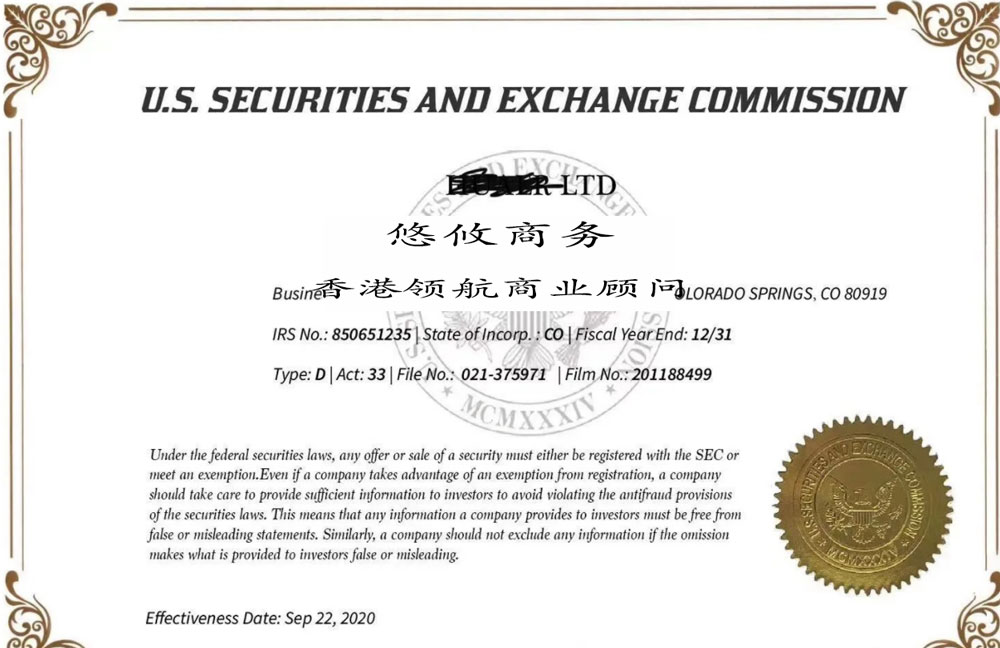

US RIA license(Registered Investment Advisor)by the U.S. Securities and Exchange Commission(SEC)or an investment adviser license issued by a state regulatory agency,Allow licensed institutions or individuals to provide professional investment consulting and asset management services。

Under the Investment Advisers Act of 1940,Any institution or individual that provides investment advice to U.S. clients for a fee must register as an RIA。

| Advantages | Specific instructions |

|---|---|

| legal compliance | Meet U.S. Securities Regulation Requirements,Legally conduct investment consulting business |

| Professional reputation | Pass strict review,Improve institutional credibility |

| Customer trust | Regulated by SEC,Enhance investor confidence |

| Service scope | Can provide a full range of investment consulting and asset management services |

| Transparent fees | Mandatory disclosure of fee schedules,Protect customer rights and interests |

| independence | Not restricted to specific financial institutions or products |

Statistics as of 2018:

Well-known licensed institutions include:

The RIA license is for the U.S. investment consulting industry”Admission ticket”,The application process is complex but highly standardized。After successfully obtaining the license,Institutions will obtain legal qualifications to provide professional investment services in the U.S. and global markets。