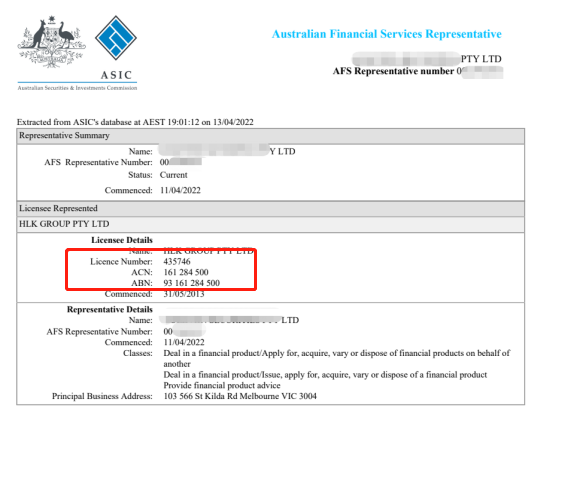

front page - Serve - Overseas financial license - Australian AFSL license

If you need to engage in the following businesses in Australia,It is required by law to apply for an Australian financial license:

1. extensive pension、Insurance、Deposit and loan industry practitioners;

2. Local banking financial institutions and international bank branches operating in Australia;

3. securities、futures、Forex、Financial derivatives and other financial trading institutions;

4. All practitioners involved in financial product information consulting and services;

5. All financial industry practitioners must hold a certificate to work,and engage in financial business in accordance with regulations。

1. Perfect government functions,Independent management of financial markets

2. Comprehensive supervision system,Pay equal attention to both supervision and management

3. in financial operations,Assist and protect retailers and customers

4. Pay attention to protecting the rights and interests of investors,FOS dispute resolution body established

5. There are strict penalties for any violation of the law

6. More open and fair information release,ensure public interest

7. Improve service levels through new technologies and processes

1.Provide advice to clients on financial products。

2.Trading financial products。

3.Provide a market for financial products。

4.Operate a registered financial business。

6.Providing traditional trust company services。

1.Company application or individual application;

2.Company registration information or personally identifiable information will all be displayed on the financial services regulatory website;

3.If you are applying for an institution or organization,It is necessary to pay attention to what type of institution it is,Trust,fund,association,Organization etc.

(What kind of trust,What kind of fund,What kind of association);

4.name of message,address,website,member,Architecture,market,serial number,Contact details etc.;

5.Major categories of financial services requiring authorization;Explain the major business types separately,Nature of business,Business specific information (product,Service list);

6.Financial services transaction volume,Transaction object,Transaction methods, etc.;

7.Whether it is necessary to restrict the development areas of institutions and investor development areas, etc.,and perform authorization, etc.;

1、Register an Australian company;

2、Assist clients with notarization of directors’ criminal records;

3、Write a business plan、and operational plans;

4、Prepare and write application materials;

5、Drafting anti-money laundering regulations and anti-terrorist financing regulations,and the daily operation plan of the regulations;

6、Submit an application for a license to the Australian ASIC;

7、In the application process,Responsible for answering questions raised by ASIC。