Apply for a money service operator MSO license in Hong Kong,Bank account opening has always been recognized as a difficult challenge。As global anti-money laundering regulations continue to tighten,The due diligence standards of major banks in Hong Kong for MSO customers have reached unprecedented heights。

core challenge:Why are bank inspections so strict?

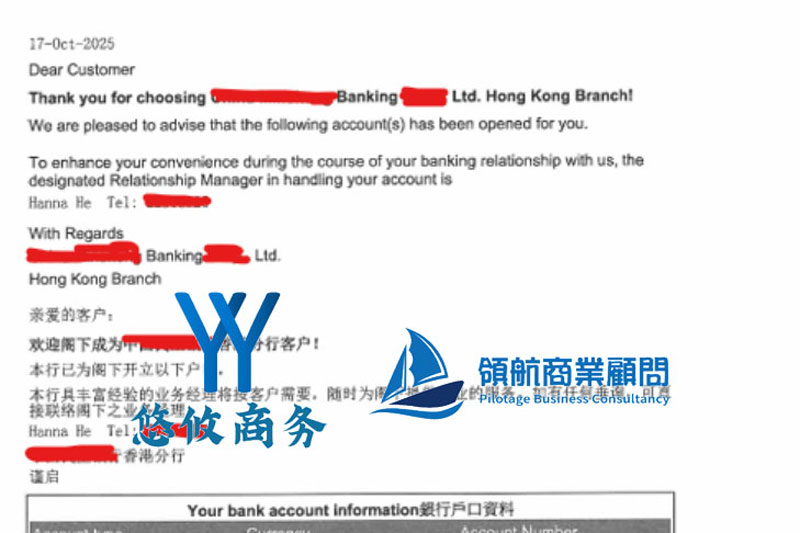

Recently, Shenzhen Youyou Business,2025October 17th,Successfully assisted a client who was applying for an MSO license in Hong Kong,Successfully completed account opening under strict bank review environment。The experience of Youyou Business shows that,The root cause of strict bank review lies in the dual considerations of "supervision and risk"。

1. High regulatory requirements:AMLO’s cornerstone role

MSO business involves cross-border capital flows and currency exchange,Belongs to Hong KongAnti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance(AMLO) strict regulatory scope。

Hong Kong Customs and Excise Department (C&ED) Requirements for license applicants:

Comprehensive AML/KYC policy: Sound anti-money laundering (AML) and customer identification (KYC) internal systems must be established。

Sound internal controls: Have internal audit、Risk assessment and compliance officer mechanism。

Enterprises must meet these requirements institutionally,To gain the trust of the bank。

2. Bank’s “Double Review” Logic (Practical Observation)

When a bank opens an account for an MSO applicant,Not just doing business due diligence,In fact, it is also simultaneously evaluating whether the company has the potential conditions to obtain an MSO license.。

bank perspective: If a company doesn’t even have the most basic compliance documents、The source of funds cannot be clearly proven to the bank,Then it will be difficult for it to meet the customs licensing standards in the future.。

The bank will use this as a basis to decide whether to take the risk of working with this high-risk customer。

key to success: Prepare business plan in advance、Funding Source Statement and Compliance Structure Document,Need to meet both the bank's risk control department and the customs license approval department's two sets of standards。

coping strategies:Risk appetite and account opening practices of different banks in MSO account opening practices,Choosing the right type of bank is crucial。

| Bank type | Risk Appetite Assessment | Account opening features and requirements |

| Large international banks (Such as HSBC、Standard Chartered) | extreme caution |

High threshold,Tend to turn away new MSO customers or require extremely high funding thresholds and business transparency。

|

| Local small and medium-sized banks | relatively flexible |

Willing to accept MSO customers,However, it requires the submission of extremely detailed operating documents、Fund flow forecasts and management background information。

|

| virtual bank (Like ZA Bank、livi) | Novel but rigorous |

Partially accepted MSO customers,Process depends on online,However, the requirements for compliance documents and system architecture are equally strict and detailed.。

|

The experience of Youyou Business shows that:

Even if the account opening policy is tightened,if only:

1. Establish a compliance framework that meets AML requirements in advance;

2. Clearly present the true business model and funding sources to banks;

3. Accurately select banks that match corporate risk characteristics,MSO account opening success rate will be greatly improved。

in conclusion:Compliance is the core competitiveness of MSO business to win trust,Opening a bank account with a Hong Kong MSO license is a practical challenge that tests professionalism。It forces companies to,Compliance must be regarded as a core competitiveness。

Is your business currently facing an application?Hong Kong MSO LicenseDifficulties in opening an account with MSO Bank?

Welcome to contact Shenzhen Youyou Business,Get professional compliance guidance and one-stop license application services。

References:

Money Services Operator (MSO) License:Hong Kong Customs and Excise Department MSO Supervision Home Page

Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance (AMLO):Hong Kong Monetary Authority AMLO Legislation Page

Hong Kong Customs and Excise Department "Licensing Guidelines":Hong Kong Customs and Excise Department MSO Licensing System Website Map